Throughout this crisis, you most likely have a lot of questions about how COVID-19 is impacting the housing market. We want to make sure to provide you with the most information that we can so you can know what to expect when buying or selling your home.

How Is the Economy Going to Be Impacted by COVID-19?

During the past few weeks, the federal government has enforced that non-essential businesses either move to work remotely or shut down completely. Throughout this past quarter, there was a large growth in the economy in January and February. Towards the end of this quarter, things decided to slow down because of businesses closing. In the next quarter, the economy is expected to contract. In order for the economy to still grow and sustain, congress needs to approve a fiscal stimulus. This includes giving loans to small businesses in order to function throughout this period of closures.

How Will the Economy Recover From COVID-19?

The economy will eventually recover from a potential recession. The question is whether or not the recovery will be on a “V” shaped recovery or a “U” shaped recovery. A “V” shaped recovery means that the economy goes down quickly then it recovers quickly. A “U” shaped recovery means that the economy goes down, languishes down for a while then slowly recovers. According to Windermere Chief Economist Matthew Gardner, the second half of this year will be significantly better than the first half.

How Does COVID-19 Affect Housing?

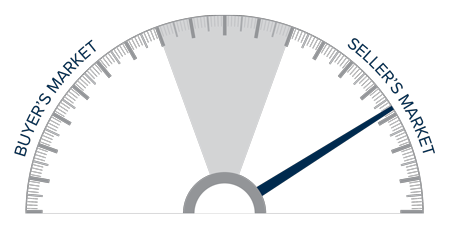

Home sellers are becoming increasingly cautious about listing their homes, meaning that the amount of listings is likely to decrease the remainder of this quarter and even into the next. They want to make sure that proper precautions are taking place before strangers enter their home. However, this doesn’t mean that every market nationwide will be as greatly impacted by COVID-19 as others. On the other hand, homebuyers have a different perspective than home sellers. They want to take advantage of the low mortgage rates. Those with sturdy jobs throughout this time are more likely to move than those who are still at risk of being laid off. People who have to take money out of the stock market to purchase a home are also less likely to purchase a home at this point as well. There will likely be a 10-15% contraction in home sales across the market.

Will Interest Rates Be Affected?

While interest rates did drop significantly a few weeks ago, they actually increased this past week. Many people were refinancing their homes, causing these interest rates to suddenly increase. It is still very likely that interest rates will drop again in the coming weeks.

What Will the Next Several Weeks Look Like?

The weeks and months to come are expected to be very difficult; however, there is a light at the end of the tunnel. Different markets will be affected in different ways, but many of them are only going to experience short term problems. Casinos and resorts are likely to take a larger hit because people will not be able to visit them. The second housing market will also likely take a hit because those are discretionary purchases. Our best advice is to continue to support small businesses if you have the means by buying gift cards and ordering out in order to support the industries affected.

This is an uncertain time for everyone in the world, but the best thing you can do is educate yourself. Understand where the economy stands and where it is expected to go, so you can make the best decisions for yourself and your family.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link